搜索结果: 1-15 共查到“税务管理学 Tax”相关记录31条 . 查询时间(0.109 秒)

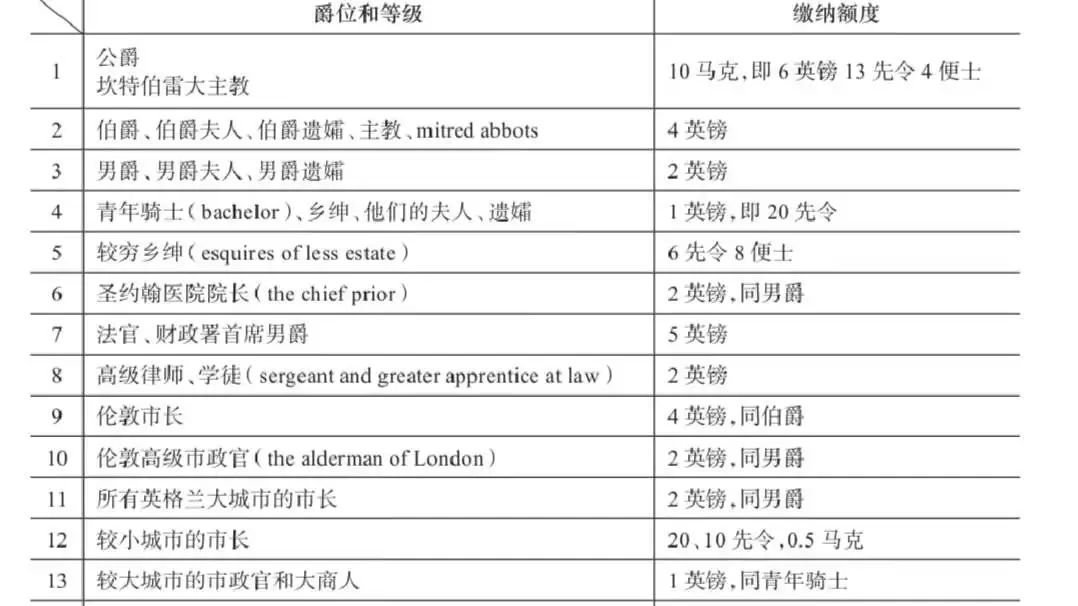

英国中古时期的poll tax是面向全国民众征收的一个具有普遍性特征的税项,国内出版物通常将之与古代中国的“人头税”对译,而忽略了两者间的差别,为避免引起误解,本文将之音译为普尔税。关于普尔税的征收,学术界大多结合瓦特•泰勒起义进行评价,基本持否定观点,但具体考察征收过程可见,其征收不仅合理、合法,而且具有一定的先进性。

Effects of US Tax Policy on Greenhouse Gas Emissions

Greenhouse Gas Emissions Tax Policy

font style='font-size:12px;'>

2015/9/18

The project that is the subject of this report was approved by the Governing

Board of the National Research Council, whose members are drawn from the councils of

the National Academy of Sciences, th...

Comment on ‘Tax Policy and Investment’ by Kevin Hasset and R. Glenn Hubbard

Tax Policy Investment

font style='font-size:12px;'>

2015/8/4

Comment on ‘Tax Policy and Investment’ by Kevin Hasset and R. Glenn Hubbard.

Do people respond to tax incentives? An analysis of the Italian reform of the deductibility of home mortgage interests

Tax incentives Mortgage market

font style='font-size:12px;'>

2015/7/23

Before 1992 mortgage interests in Italy were fully tax deductible up to 3500 Euro (7000 for two

cosigners). In 1992–1994 the government implemented a series of tax reforms whose ultimate effect

was ...

Climate change policy's interactions with the tax system

Climate change policy Carbon tax Cap and trade Revenue-neutral Tax-interactions General equilibrium impacts

font style='font-size:12px;'>

2015/7/17

This paper presents a range of insights from recent literature on how climate-change policies and other environmental policies interact with the fiscal system. It explores four issues associated with ...

How has tax affected the changing cost of R&D?Evidence from eight countries

Tax credits R&D cost of capital

font style='font-size:12px;'>

2015/7/15

This paper describes the evolution of the tax treatment of investment in R&D in Australia, Canada, France, Great Britain, Germany, Italy, Japan and the USA between 1979 and 1994. Estimates of the cost...

Do R&D tax credits work?Evidence from a panel of countries 1979–1997

Tax credits R&D Panel data Tax competition

font style='font-size:12px;'>

2015/7/15

This paper examines the impact of fiscal incentives on the level of R&D investment. An econometric model of R&D investment is estimated using a new panel of data on tax changes and R&D spending in nin...

Eliciting Taxpayer Preferences Increases Tax Compliance

Motivation and Incentives Taxation Public Administration Industry United States

font style='font-size:12px;'>

2015/4/29

Two experiments show that eliciting taxpayer preferences on government spending―providing taxpayer agency―increases tax compliance. We first create an income and taxation environment in a laboratory s...

Investable Tax Credits:The Case of the Low Income Housing Tax Credit

Investment Governing Rules Regulations and Reforms Taxation

font style='font-size:12px;'>

2015/4/22

The Low Income Housing Tax Credit (LIHTC) represents a novel tax expenditure program that employs "investable" tax credits to spur production of low-income rental housing. While it has grown into the ...

The Association of Tax Advisor

The Association of Tax Advisor ATA

font style='font-size:12px;'>

2014/4/10

An Association "an organisation of individuals and firms with related trading interests and goals and one formed for mutual aid and development of its members".The "Association of Tax Advisors" has be...

Canadian Tax Foundation

Canadian Tax Foundation tax

font style='font-size:12px;'>

2014/4/10

Founded in 1945 as an independent tax research organization under the joint sponsorship of the Canadian Institute of Chartered Accountants and the Canadian Bar Association, the Foundation provides a u...

Analysis of influential factors responsible for the effect of tax reduction on GDP

Agent-based modeling Tax reduction Multiplier Public expenditure Balanced finance Executive compensation, Investment

font style='font-size:12px;'>

2014/8/8

The factors responsible for the effect of a tax reduction on GDP are analyzed using both agent-based modeling (ABM), based on the authors’ previous study, and a derived set of equations for tax reduct...

《Tax Policy and the Economy》(图)

Tax Policy and the Economy Jeffrey R. Brown

font style='font-size:12px;'>

2013/11/27

Taxation policy was a central part of the policy debates over the “fiscal cliff.” Given the importance of fiscal issues, it is vital for rigorous empirical research to inform the policy dialogue.In ke...

Development of Tax Policy in New Zealand: The Generic Tax Policy Process

Tax policy policy making T ax legislaT ion process ew Zealand

font style='font-size:12px;'>

2014/4/10

The Process for Making Tax Policy in the United States: A System Full of Friction

Tax policy policy making T ax legislaT ion process UniT ed sTaT es

font style='font-size:12px;'>

2014/4/10

The American Revolution (1775-1783) resulted in the independence of 13 of Great

Britain’s North American colonies. In the 1780s, leaders of the new American nation

realized that the national gover...